Document Collector Software | Collect, Verify, and Manage Documents

Table of Contents

[ show ]- Loading table of contents...

Brianna Valleskey

If your team wastes hours chasing down client documents or correcting paperwork errors, you’re not alone. The constant chasing documents process can be eliminated with automation, reducing follow-ups and streamlining collection.

Manual document collection is a bottleneck — it’s inefficient, insecure, and hard to scale. But with automated document collection software like Inscribe’s Collect, businesses can modernize how they request, receive, and review sensitive documents — all while improving compliance, conversion, and customer satisfaction.

What is document collection software?

Document collection software is a specialized digital platform that automates and secures the process of requesting, receiving, organizing, and reviewing documents from customers, applicants, or partners. Instead of relying on outdated methods like email chains, unsecured file shares, or fragmented in-house tools, which often lead to chaos and inefficiency when managing document collection through a cluttered email inbox, businesses can use a centralized, purpose-built solution to streamline their document workflows from start to finish.

These platforms eliminate friction for both the business and the end user by offering a professional, intuitive experience for uploading and tracking documents — helping organizations reduce processing times, increase response rates, and maintain regulatory compliance. Most importantly, the right document collector tool ensures the accuracy, integrity, and security of each submission, which is critical when dealing with sensitive personal or financial information.

Inscribe’s Collect: Secure, automated document collection

Inscribe’s Collect feature is a next-generation automated document collection solution designed for modern risk, fraud, and onboarding teams.

Curious how Collect works from the customer’s perspective? Take a self-guided, interactive tour to experience how easy it is to request and receive documents using Inscribe’s automated document collection software.

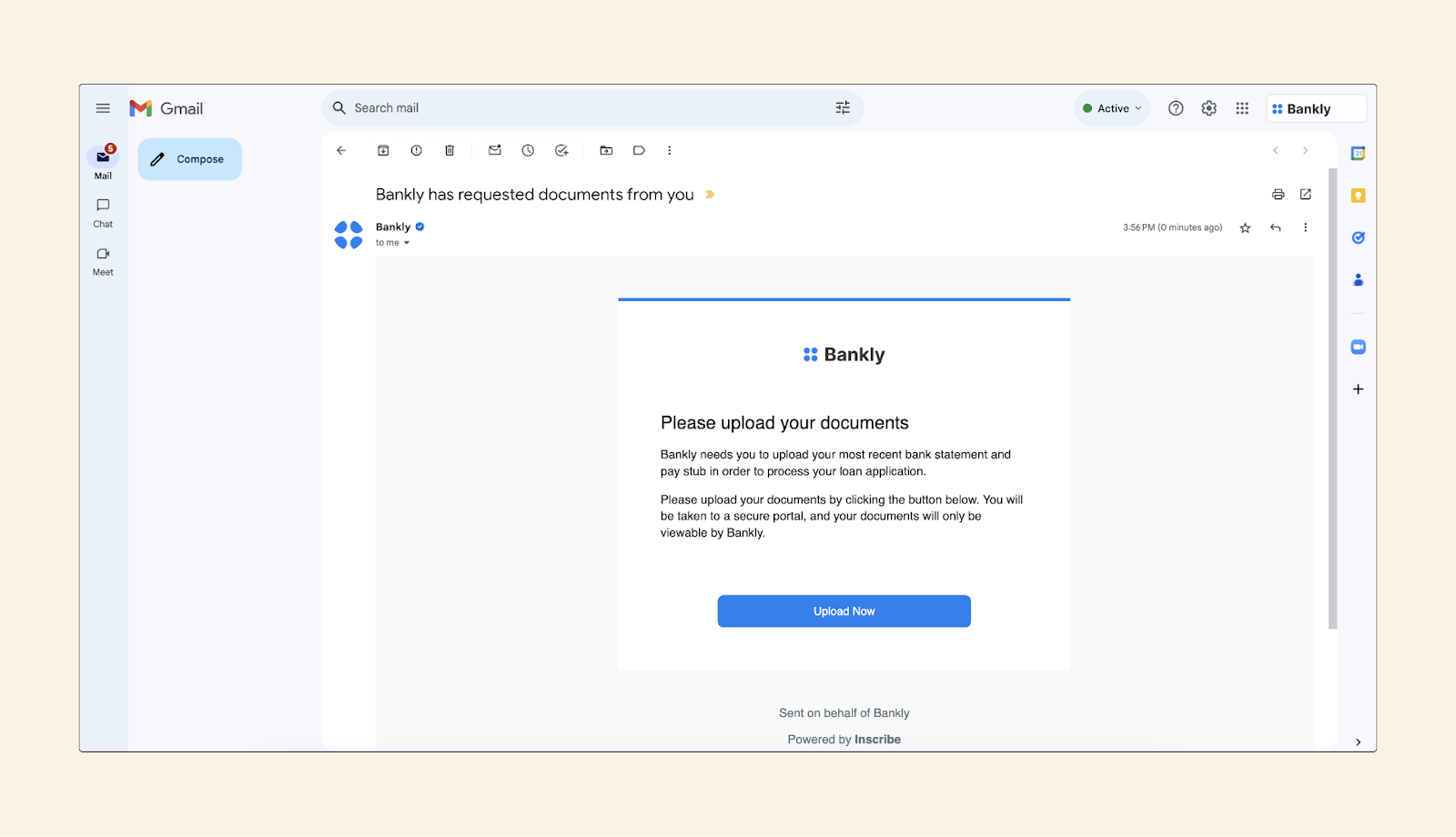

With Collect, businesses can send branded document requests via email or generate shareable links to capture documents like:

- Bank statements

- Government-issued IDs

- Utility bills

- Business registration records

- Tax documents and more

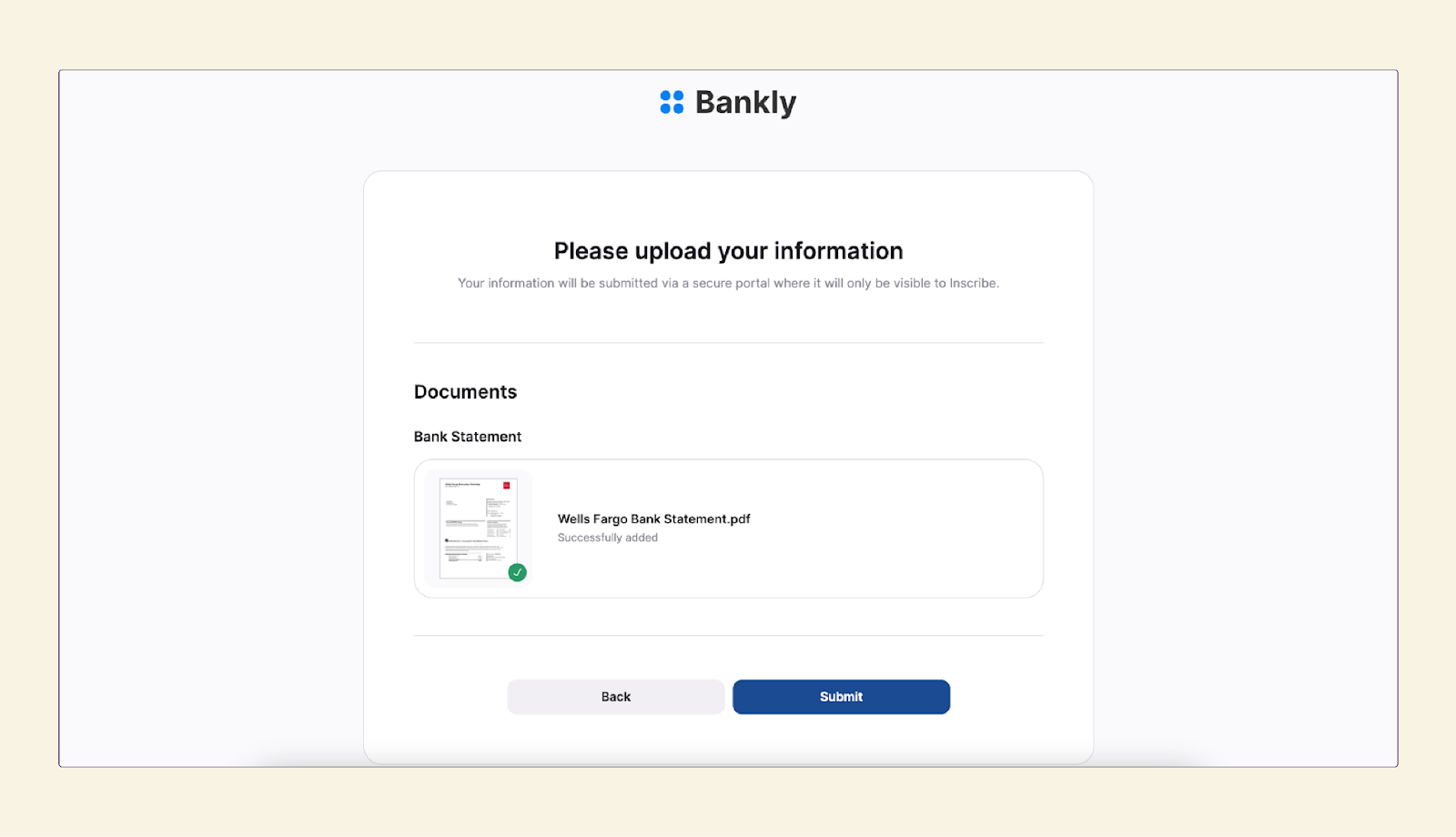

Applicants or customers are guided through a frictionless upload process where they simply drag and drop their documents into a secure, mobile-friendly client portal (no login required). There is no need for a login or remembering login credentials, making the process simple and user-friendly. This client portal provides a centralized, secure location for document collection, streamlining the experience and reducing errors and follow-up time. What makes Collect stand out is what happens next:

As soon as files are submitted, Inscribe’s built-in AI reviews them in real-time. The platform instantly validates whether the correct type of document has been uploaded, checks for formatting or date issues (e.g., expired statements), and flags signs of potential fraud or manipulation. Businesses are notified immediately and can act on verified data without any manual review.

Collect acts as more than just a document collector — it becomes a critical workflow engine that automates requests, ensures compliance, reduces human error, and helps companies manage client documents.

Inscribe also offers API and iFrame integrations so you can embed Collect directly into your onboarding flows or customer portals. This seamless integration gives you complete control over the experience while maintaining high security and performance standards.

Who is automated document collection for?

Collect was built for organizations that handle sensitive customer information and need to operate efficiently and compliantly across many industries and use cases, including:

- Fintechs and digital banks

- Lenders and credit unions

- Insurance companies

- Marketplace platforms

- Risk, fraud, and compliance teams

- HR and onboarding teams

- Schools and training organizations

Whether you're onboarding a customer, evaluating creditworthiness, or verifying identity, Inscribe’s automated document collection platform reduces manual effort, human error, and customer drop-off.

By automating document collection processes, these industries reduce manual errors, accelerate approvals, and improve overall productivity—delivering a better experience for both clients and internal teams.

How do document collectors work?

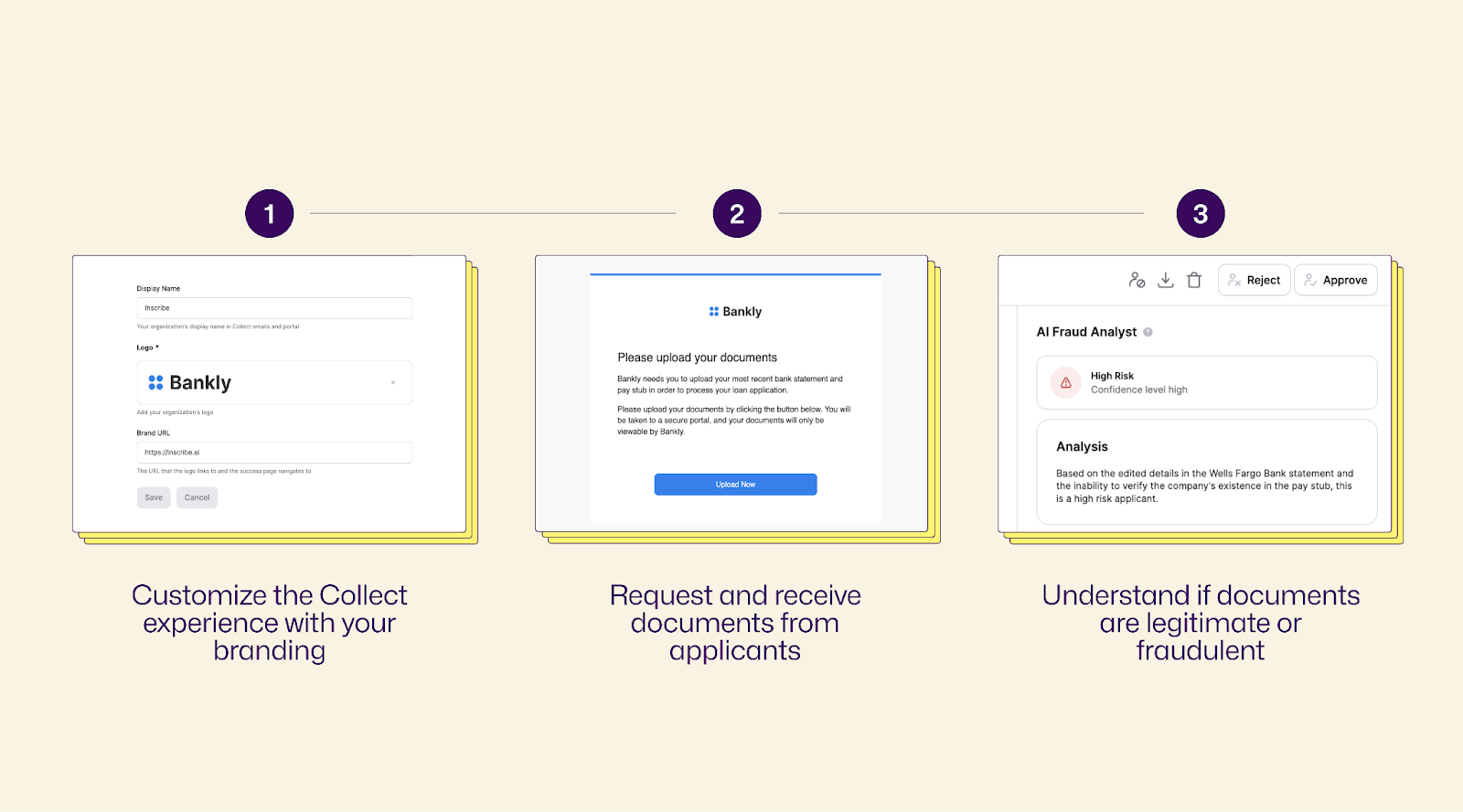

Collect makes document requests easier for both businesses and applicants in just three steps:

- Customize your Collect portal with your logo, brand colors, and request messaging.

- Request documents via email or link — configure a file request with specific requirements such as due dates, expiration dates, or automated reminders, and set built-in rules for document age, format, and type.

- Verify and review submissions instantly. Inscribe’s AI flags fraud, confirms details, and provides a digital audit trail.

You can also embed the upload experience into your website or workflow via API or iFrame for seamless integration.

Key features of Inscribe's document collector

Inscribe’s document collection software is purpose-built to remove friction from every step of the document submission process — for both your team and your customers. You can easily track the progress of document requests in real time, ensuring you always know the status of outstanding requests and which clients may need reminders or follow-up. Below is a closer look at the powerful features that make Collect the preferred choice for compliance-focused and high-growth businesses:

Custom-branded upload portals

Create a seamless, professional experience that reinforces trust and brand recognition.

- Fully customize your Collect portal with your company’s logo, colors, and language.

- Send document requests that feel like a natural extension of your own platform — not a third-party tool.

- Maintain a consistent customer experience across every touchpoint, improving confidence and conversion rates.

You can also create or reuse a template for your branded upload portals, ensuring consistency and saving setup time.

Branded portals reduce drop-off and boost credibility, especially during sensitive workflows like onboarding or identity verification.

Automated request rules & real-time feedback

Ensure customers submit the right documents — the first time.

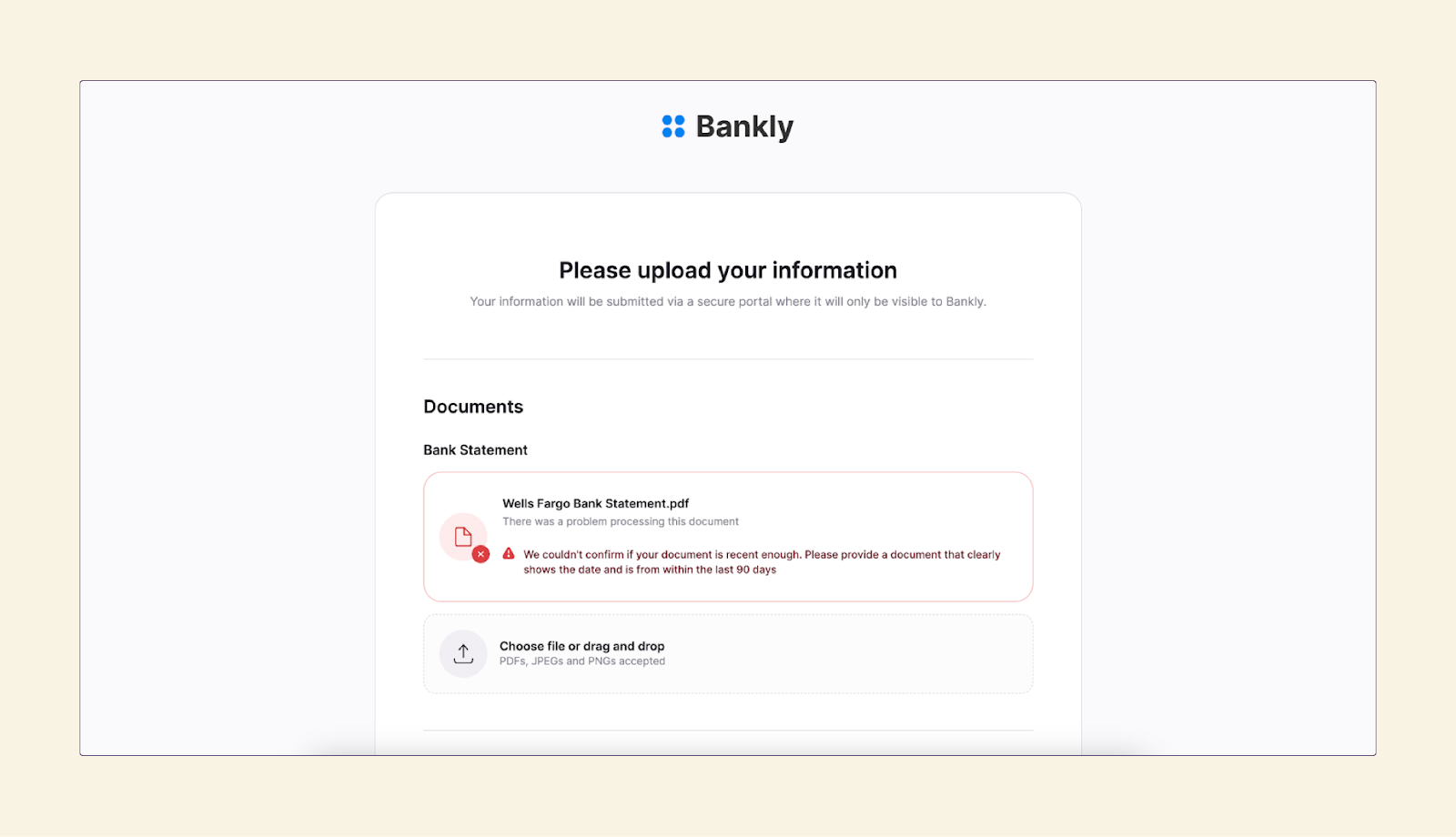

- Define specific requirements for each document type: format (PDF, JPEG), recency (e.g., less than 90 days old), page count, or content (e.g., must include customer name).

- Collect automatically checks uploaded documents against these rules in real-time.

- If an applicant uploads an incorrect file, Collect provides on-screen guidance and applicants are prompted to correct the issue before submission.

- Use forms to collect structured data alongside document uploads, streamlining the data collection and document management process.

This reduces back-and-forth communication, accelerates processing times, and increases document request completion rates.

AI-powered fraud detection

Built-in intelligence flags fraud and saves your team hours of manual review.

- As soon as a document is submitted, Inscribe’s AI Risk Agents scan for signs of tampering, forgery, and manipulation.

- Collect extracts key data points from the documents (names, dates, account numbers) and verifies them for consistency. Metadata from submitted files is securely stored and analyzed to enhance fraud detection and ensure data protection.

- Generate instant risk reports that provide audit-ready insights and help your team make faster, more confident decisions.

Whether you’re underwriting loans or screening sellers, Inscribe helps you catch fraud before it becomes a liability.

Centralized document management

One secure place to track, manage, and monitor every document request.

- Access all submissions and statuses through a single, easy-to-navigate dashboard.

- Filter by request type, customer, status (e.g., pending, submitted), or risk flag.

- Monitor engagement and performance metrics like response time, completion rate, and verification outcomes.

- Track document version history to ensure all stakeholders are working with the most up-to-date files and avoid confusion from outdated versions.

This helps operations, fraud, and customer success teams stay aligned — and gives you full visibility into your document workflows.

Security & compliance

Protect sensitive customer data and meet the highest industry standards.

- Inscribe is SOC 2 Type 2 certified, ensuring that internal controls and processes meet strict security requirements.

- Built-in GDPR compliance features support data subject rights and secure data deletion on request.

- Granular, role-based access controls restrict access to only authorized team members, reducing the risk of data leaks or mishandling.

- File size and format limits can be set to prevent submission of oversized or irrelevant documents, helping protect data and streamline the collection process.

This level of enterprise-grade security makes Collect a trusted solution for regulated industries like banking, lending, insurance, and fintech.

Integrations & workflow flexibility

Collect was designed to collect documents from within your existing systems — no heavy lifting required.

- Integrate seamlessly via API or embeddable iFrame, allowing you to automate document requests directly from your existing onboarding or risk workflows.

- Embed Collect into your app or platform for a smooth, on-brand experience without relying on engineering resources.

- Create a custom document collection flow that fits your unique process — whether you're sending one-off requests or triggering them programmatically.

This ensures a low-lift implementation with high-impact results — just as Gig Wage and other fast-scaling fintechs have discovered.

Best practices for implementing document collection software

Successfully rolling out document collection software starts with a strategic approach. Begin by clearly defining your goals for the document collection process—whether it’s reducing turnaround times, improving compliance, or boosting productivity. Identify which documents are essential for your workflows and outline the security and compliance standards your business must meet.

Choose a flexible solution that can adapt as your organization grows and your document collection processes evolve. Integration with your existing systems is key, so look for document collection software that fits seamlessly into your current tech stack. Don’t overlook the importance of user training: equipping your team with the knowledge to use new tools ensures a smooth transition and maximizes adoption.

Finally, establish clear processes for monitoring and refining your document collection workflows. Regularly review feedback from users and stakeholders to identify opportunities for further efficiency and security improvements. By following these best practices, your business can streamline document collection, enhance security, and empower users to work more productively.

Scalability and flexibility to grow with your business

As your organization expands, your document collection needs will inevitably change. That’s why it’s crucial to select document collection software that offers both scalability and flexibility. A robust solution should handle increasing volumes of client documents and user activity without sacrificing speed or reliability.

Look for features that let you customize document collection workflows, create reusable templates, and set due dates for submissions. This flexibility allows you to automate processes, manage client documents efficiently, and adapt to new business requirements as they arise. The ability to add users, adjust permissions, and create new document types or workflows ensures your system grows alongside your business.

By investing in scalable and flexible document collection software, you future-proof your operations—enabling your team to manage more data, automate repetitive tasks, and maintain high productivity as your client base and document volumes increase.

What is the value of automated document collection?

Manual document collection processes aren’t just time-consuming—they’re a liability. Every minute your team spends emailing back and forth, chasing down missing files, or manually verifying documents is time (and trust) lost. Worse, these legacy methods introduce risk: from lost data and human error to compliance gaps and fraud exposure.

That’s where automated document collection software like Inscribe’s Collect comes in.

By transforming document workflows from reactive to proactive, Collect helps your team move faster, stay compliant, and deliver a better customer experience. Teams can easily approve documents, accept or reject submissions within a customized approval workflow, and ensure secure handling of all client files. You can also save templates and settings for future use, streamlining repetitive tasks and increasing efficiency. Plus, Collect enables you to send automated SMS reminders to clients, alongside email notifications, to ensure timely document submission.

Here’s what you gain with Collect:

- 80% response rates: Collect removes friction from the submission process with branded portals, no-log-in access, and real-time document feedback — making it easier for applicants to follow through. Gig Wage achieved an 80% document request response rate after implementing Collect.

- 30+ minutes saved per application: No more back-and-forth with customers to get the right file, format, or page. Collect’s document verification rules do the heavy lifting, so your team can stop chasing paperwork and focus on decision-making.

- 2 days cut from onboarding timelines: Automated workflows and instant AI-powered fraud checks let you process applications faster, reducing wait times and improving time-to-yes. This gives your team a competitive advantage in fast-moving markets like lending or fintech.

- Higher conversion rates and customer satisfaction: A smooth, secure upload experience builds trust from the first interaction. Collect’s intuitive UI, mobile responsiveness, and instant validation reduce drop-off, boost conversion, and keep your pipeline moving.

- Faster fraud detection without extra headcount: Inscribe’s AI Risk Agents analyze uploaded documents for signs of fraud (e.g., tampering, identity mismatch) in real-time. Teams can confidently approve or reject applications without manual reviews.

- Compliance confidence at scale: Collect helps you meet regulatory requirements — including SOC 2 Type 2, GDPR, and data retention laws — through encrypted storage, audit trails, and access controls. You get peace of mind while growing your business.

Inscribe’s document collector isn’t just a standalone tool — it’s a critical part of our larger Risk Intelligence platform. By combining secure automated document collection with fraud detection, document parsing, and credit insight capabilities, Collect enables risk teams to:

- Eliminate manual tasks

- Prevent avoidable losses

- Scale operations without scaling costs

Whether you're onboarding new customers, verifying businesses, or preventing fraud, Collect ensures you do it faster, safer, and smarter.

Measuring the success of document collection

To ensure your document collection software is delivering value, it’s important to track key performance indicators (KPIs) and measure return on investment (ROI). Start by monitoring how quickly you can collect documents, the total number of documents processed, and the accuracy of submissions. These metrics provide insight into the efficiency of your document collection processes.

Evaluate user adoption rates and gather feedback through customer satisfaction surveys to assess how well the software meets the needs of both your team and your clients. Track the number of automated workflows and the reduction in manual tasks to quantify productivity gains.

Calculate ROI by comparing the costs of implementing and maintaining your document collection software with the benefits achieved—such as time saved, error reduction, and improved customer satisfaction. By analyzing these data points, you can make informed decisions to further optimize your document collection workflows and maximize business impact.

Why Inscribe customers choose Collect

Real-world results set Inscribe’s document collector apart from other document collection tools. Our customers aren’t just streamlining operations—they’re transforming the way they onboard, verify, and protect their users and businesses. Teams can use comments to collaborate and provide feedback directly within the document workflow, making the review process more efficient.

Here are two standout examples:

Gig Wage: Scaling faster with seamless, automated document collection

The challenge: Gig Wage, a fast-growing fintech that provides payroll and financial solutions for contractor-based businesses, struggled with a slow, manual onboarding process. Each business applicant required a custom email with document requests, which led to lengthy delays, inconsistent document quality, and high risk of fraud slipping through. Their internal fraud team was also overwhelmed by time-consuming, manual reviews.

The solution: By integrating Inscribe’s Collect API, Gig Wage was able to automate its entire document collection and verification process. Applicants received branded, mobile-friendly document request links, which guided them through secure uploads. Collect’s smart rules ensured that documents met their standards before submission, while Inscribe’s AI flagged potential fraud automatically.

The result:

- Reduced onboarding time by 2 full days, giving Gig Wage a major speed advantage

- Achieved an 80% document request response rate, improving completion and conversion

- Eliminated 30 minutes of manual processing per application, saving over 150 hours per year

- Reduced fraud risk without increasing team size, enabling confident scale

Gig Wage now delivers a faster, smoother customer experience — and their internal team can focus on high-impact tasks instead of chasing paperwork.

Mercari: Mitigating regulatory risk with secure, verified document collection

The challenge: Mercari, a global marketplace, needed a reliable way to securely collect and verify documents from sellers to comply with strict regulatory guidelines. Their previous process posed risks to both data security and operational efficiency, making them vulnerable to fines and reputational damage — especially concerning the sale of counterfeit or embargoed goods.

The solution: Mercari deployed Inscribe’s Collect to automate and secure their document collection workflows. Through customized portals and embedded document requests, sellers could easily submit required documents, which were instantly reviewed by Inscribe’s AI for fraud detection and compliance alignment.

The result:

- Improved the security of document handling with end-to-end encryption and compliance-grade storage

- Reduced processing times by 20%, accelerating seller onboarding and risk assessments

- Saved millions in potential regulatory penalties by ensuring accurate, auditable records and fraud-free documentation

With Collect, Mercari turned a vulnerable, high-risk process into a competitive strength that reinforces both compliance and customer trust.

A holistic document risk solution

Both Gig Wage and Mercari chose Inscribe’s automated document collection software not only for its ease of use, but for the intelligence behind it. Collect is backed by Inscribe’s larger Risk Intelligence platform, which combines AI-powered fraud detection, document parsing, credit insights, and workflow automation.

Whether you're a fintech startup, a global marketplace, or a regulated financial institution, Inscribe helps you collect, verify, and act on critical documents — without friction, without risk, and without needing to grow your headcount.

See Collect in action

Ready to reduce drop-off, fraud risk, and back-and-forth email chains?

Request a demo of Inscribe’s Collect today and see how our automated document collection software can help you move faster and more securely — without burdening your team.

👉 Schedule a demo with Inscribe

Future of document management — what’s next?

The landscape of document collection and management is rapidly evolving, driven by advancements in artificial intelligence, machine learning, and blockchain technology. These innovations are set to further automate document collection processes, enhance document accuracy, and strengthen security.

AI-powered tools are making it easier to extract and classify data from documents, automatically route files to the right workflows, and identify potential issues before they become bottlenecks. Machine learning algorithms can predict document volumes and optimize processes for greater efficiency. Meanwhile, blockchain technology is poised to revolutionize document security by ensuring the authenticity and integrity of documents, making unauthorized access or tampering nearly impossible.

As these technologies mature, organizations can expect even more intuitive, secure, and efficient document collection solutions—enabling them to automate more processes, safeguard sensitive data, and deliver exceptional client experiences well into the future.

Frequently Asked Questions (FAQs)

What kinds of documents can I collect with Inscribe?

You can collect bank statements, identity documents, proof of address, business formation records, and more.

Is Inscribe’s Document Collector secure enough for financial institutions?

Yes. Inscribe is SOC 2 Type 2 certified, GDPR compliant, and uses AES-256 encryption to protect sensitive data in transit and at rest.

Can I integrate Collect with my onboarding flow?

Absolutely. Collect offers API and iFrame options so you can embed document collection into your website or workflow.

Can Inscribe’s document collection software detect fake or altered documents?

Do I need engineering resources to implement automated document collection from Inscribe?

Not necessarily. Collect can be used as a low-code/no-code solution, and our team supports full onboarding to get you live quickly.

About the author

Brianna Valleskey is the Head of Marketing at Inscribe AI. A former journalist and longtime B2B marketing leader, Brianna is the creator and host of Good Question, where she brings together experts at the intersection of fraud, fintech, and AI. She’s passionate about making technical topics accessible and inspiring the next generation of risk leaders, and was named 2022 Experimental Marketer of the Year and one of the 2023 Top 50 Woman in Content. Prior to Inscribe, she served in marketing and leadership roles at Sendoso, Benzinga, and LevelEleven.

Learn More

Dive deeper into our Solutions

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.