From forgeries to deepfakes: Document fraud in the age of generative AI

Table of Contents

[ show ]- Loading table of contents...

Ronan Burke

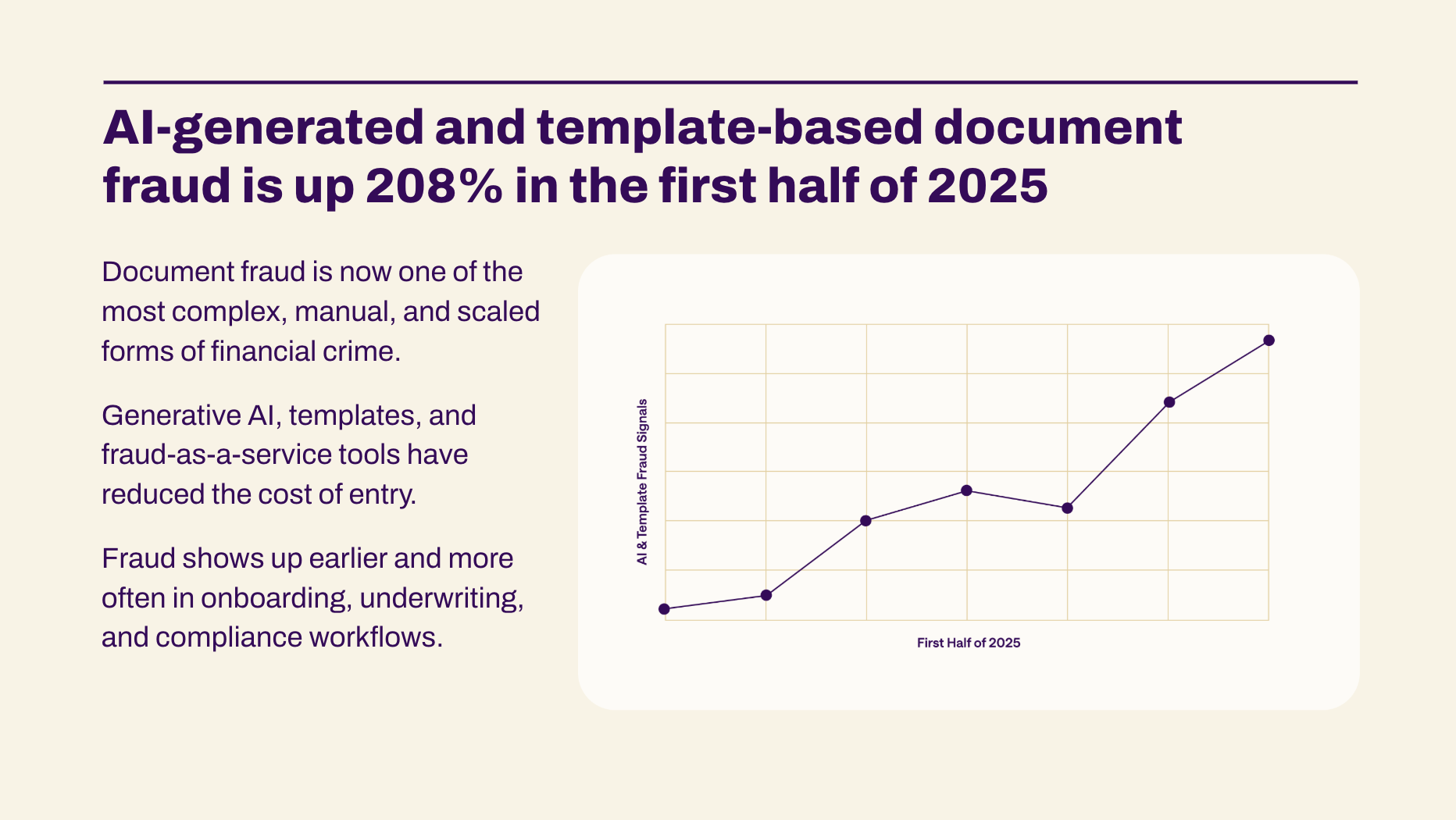

Document fraud has quietly become one of the most complex and manually intensive forms of financial crime.

We see it every day: forged paystubs, fake bank statements, synthetic utility bills, and more all designed to mislead underwriting and compliance systems.

In the last few months, especially, generative AI has redefined what's possible. But it's also redefined what's risky. Among the many sectors disrupted by the rise of deepfake media, document-based financial workflows are among the most vulnerable. We’re entering an era where it’s no longer a question of whether a document looks real — but whether it can prove it’s real.

Sam Altman, CEO of OpenAI, recently warned the Federal Reserve of an impending "fraud crisis." His words were blunt: "AI has fully defeated most of the ways that people authenticate currently, other than passwords."

With modern AI tools, replicating a voice (or soon, a face) is trivial. The same applies to documents.

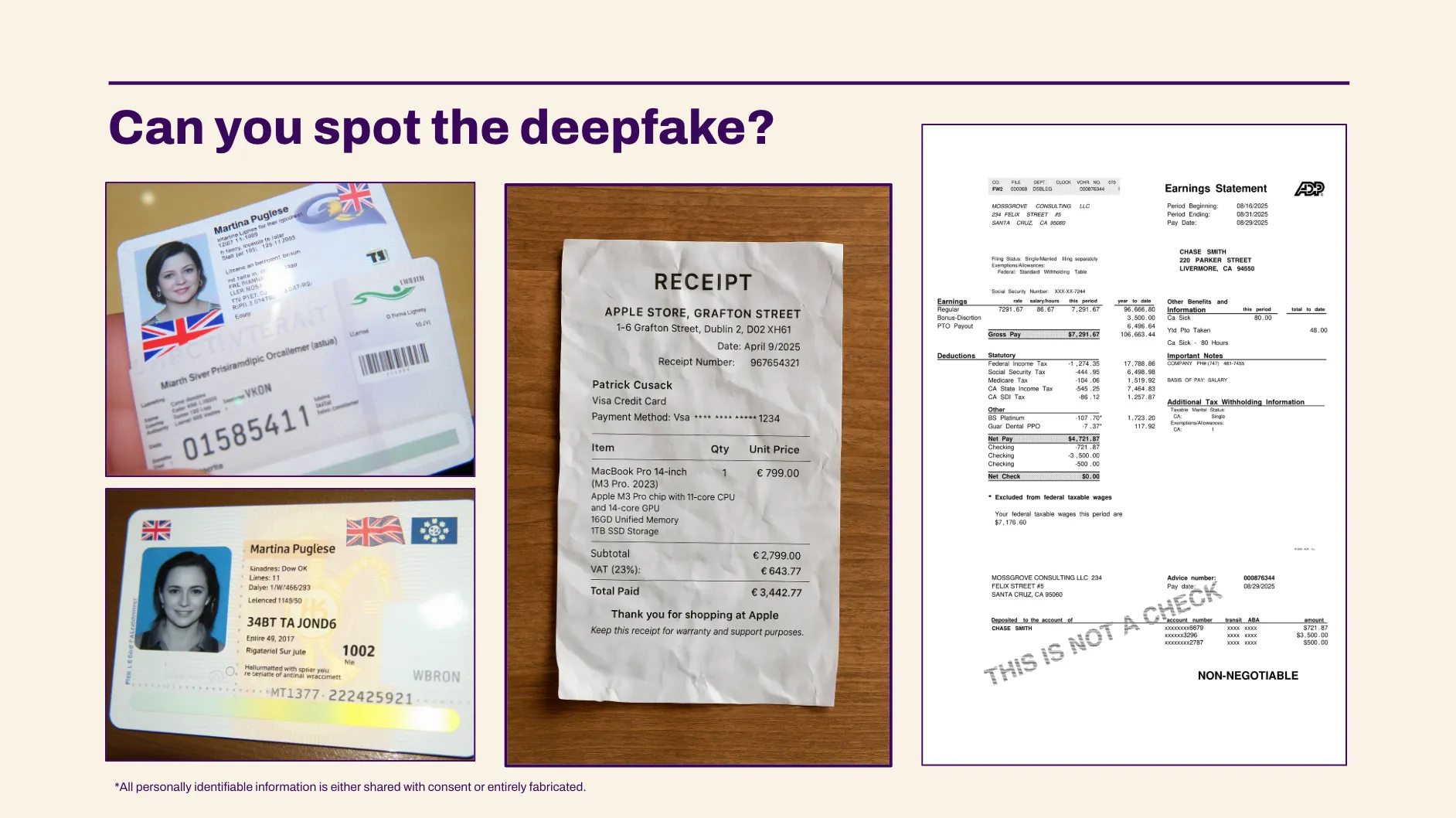

Document deepfakes are here

Receipts, paystubs, utility bills, and bank statements can now be spun up in seconds using open-source image generation models, or created by a single prompt using multimodal LLMs.

At first glance, these fakes look legitimate. They contain realistic lighting, crinkled paper textures, shadows, and logos. But a closer inspection reveals subtle inconsistencies — mismatched number formats, phantom store locations, odd typos. Errors that are easy to overlook and increasingly rare as these models improve.

What makes this threat especially dangerous is the low cost and high scalability. Fraud-as-a-service marketplaces are proliferating, offering thousands of high-quality forgeries for under $10 each. Meanwhile, financial institutions are still verifying documents with systems built for a different era, one where fraud was rare, not embedded in the volume.

At Inscribe, we’ve studied these models closely. We’ve reverse-engineered their quirks and trained our systems to catch the digital fingerprints they leave behind. But the pace of generative AI means that traditional detection methods are already outdated. This isn’t a future problem—it’s live, growing, and impacting businesses today.

Founding insight: why we started Inscribe

This challenge isn’t new to us. My brother Conor and I founded Inscribe in 2017 after experiencing the broken state of document verification firsthand. Conor, working at a major bank in Ireland, saw how digitization efforts constantly failed at one critical point: authenticating documents without overwhelming fraud and risk teams. He and his colleagues were drowning in manual reviews, with no scalable way to separate genuine applications from fraudulent ones.

At the same time, I felt the customer-side pain: delays and frustration when applying for financial products that should have been instant. We realized that the core problem wasn’t just inefficiency, but rather the growing sophistication of fraud itself. To fix it, we would need to build systems that could reason like the best fraud analysts, but with the speed and scale only AI could provide.

From day one, we approached document fraud by going back to first principles. Instead of relying on static rules, we built specialized detectors to uncover tampering, template reuse, and synthetic identity patterns. We invested in foundational infrastructure to parse complex financial documents, extract subtle fraud signals, and flag inconsistencies with confidence. That early work enabled our customers to catch millions in fraud that would have otherwise slipped through undetected.

But we also saw the limits. Even with advanced detectors, investigations were still painfully manual. Analysts spent hours toggling across systems, validating employers, matching addresses, and stitching together context. Detection alone wasn’t enough. The system needed to explain itself, to reason, and to adapt as fraud evolved.

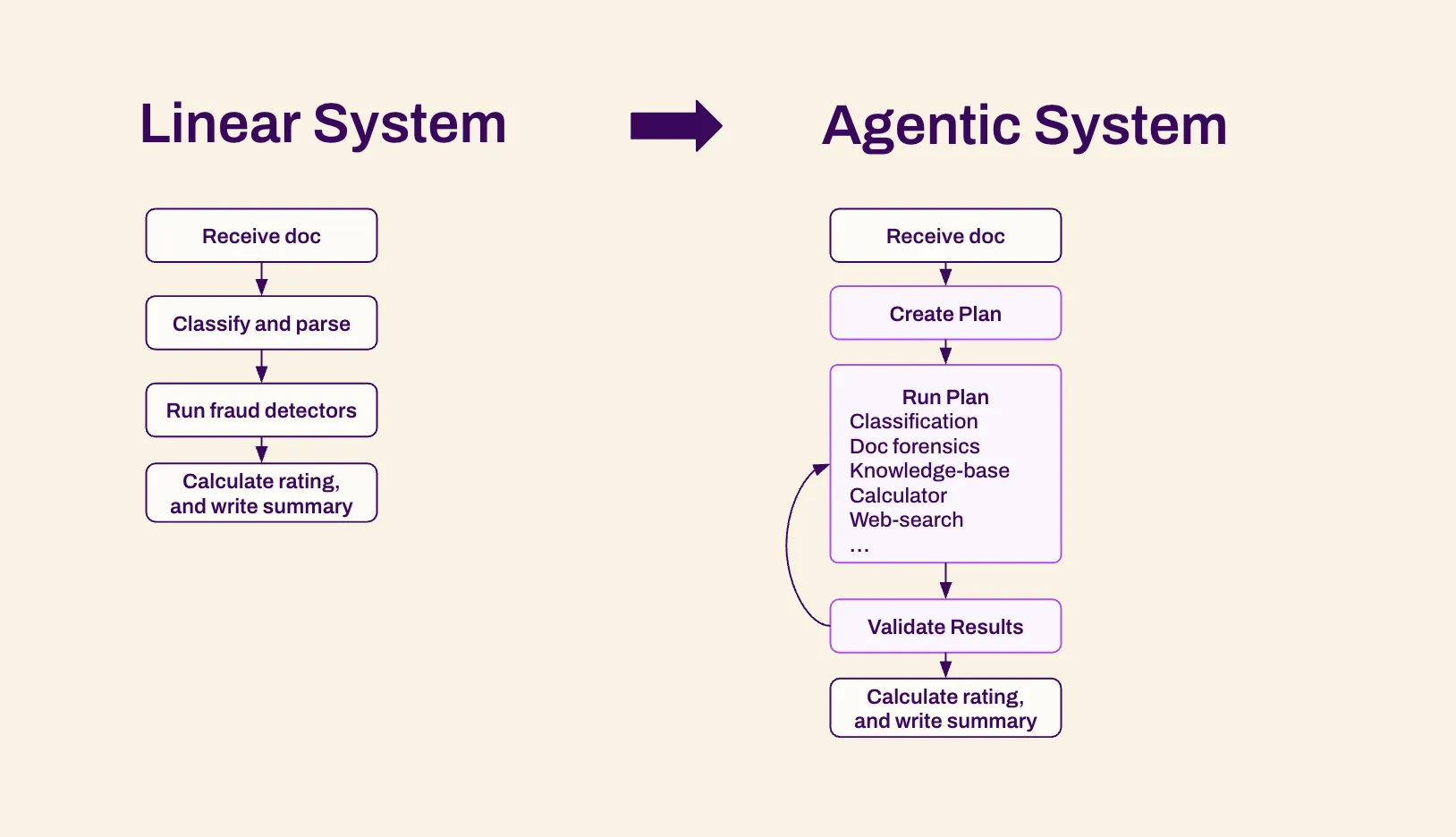

Our journey from linear systems to agentic systems

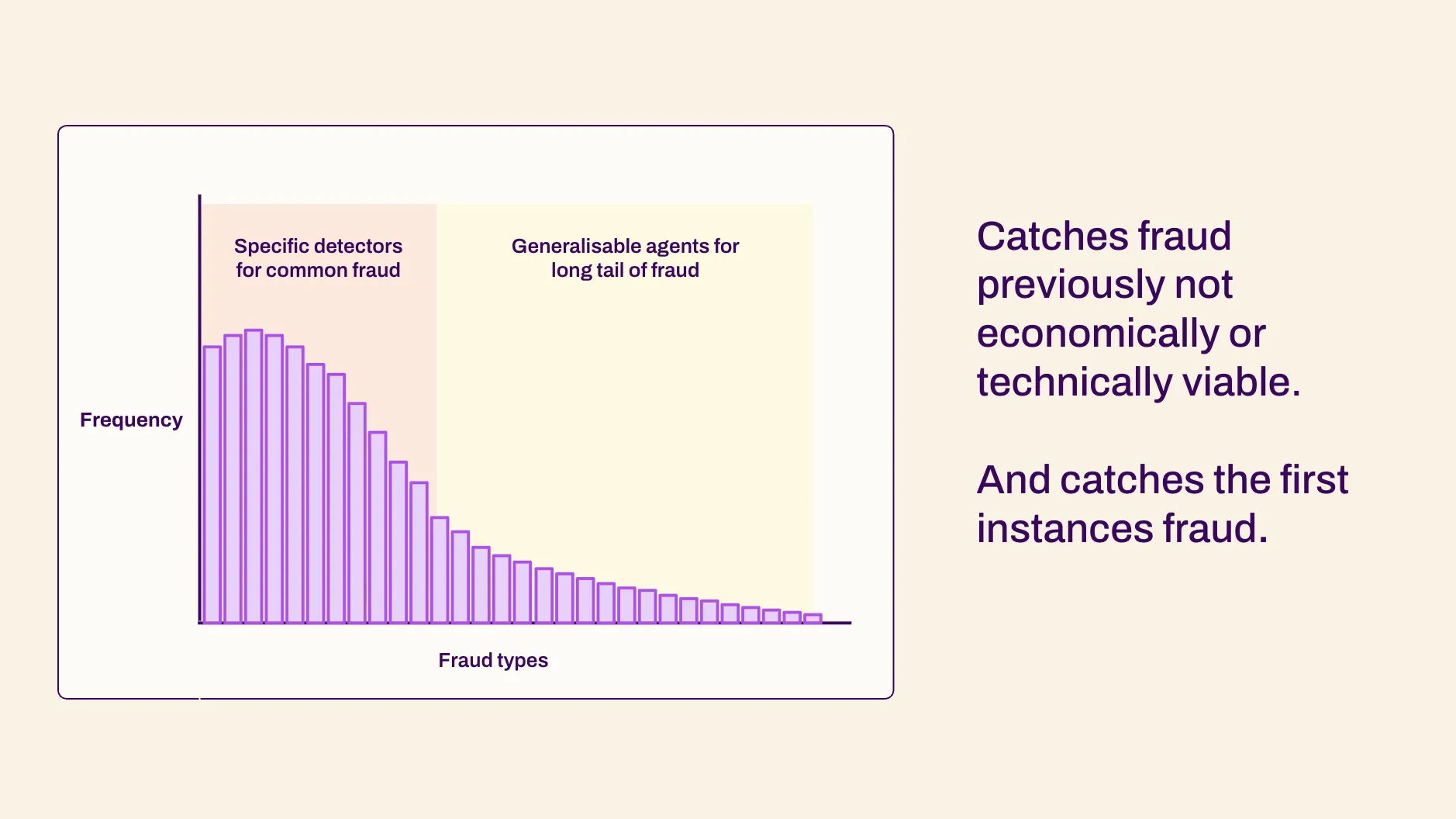

Most fraud tools today are linear. They classify, run a detector, and spit out a score. That works for common fraud patterns, but breaks down when tactics shift or when fraud shows up in unexpected forms.

Agentic systems are different. Instead of running a fixed playbook, they create a plan, choose the right tools, and adapt in real time as new evidence emerges. An agent can combine document forensics, database queries, web search, and external APIs into a single investigation — validating results along the way and explaining how it reached its conclusion.

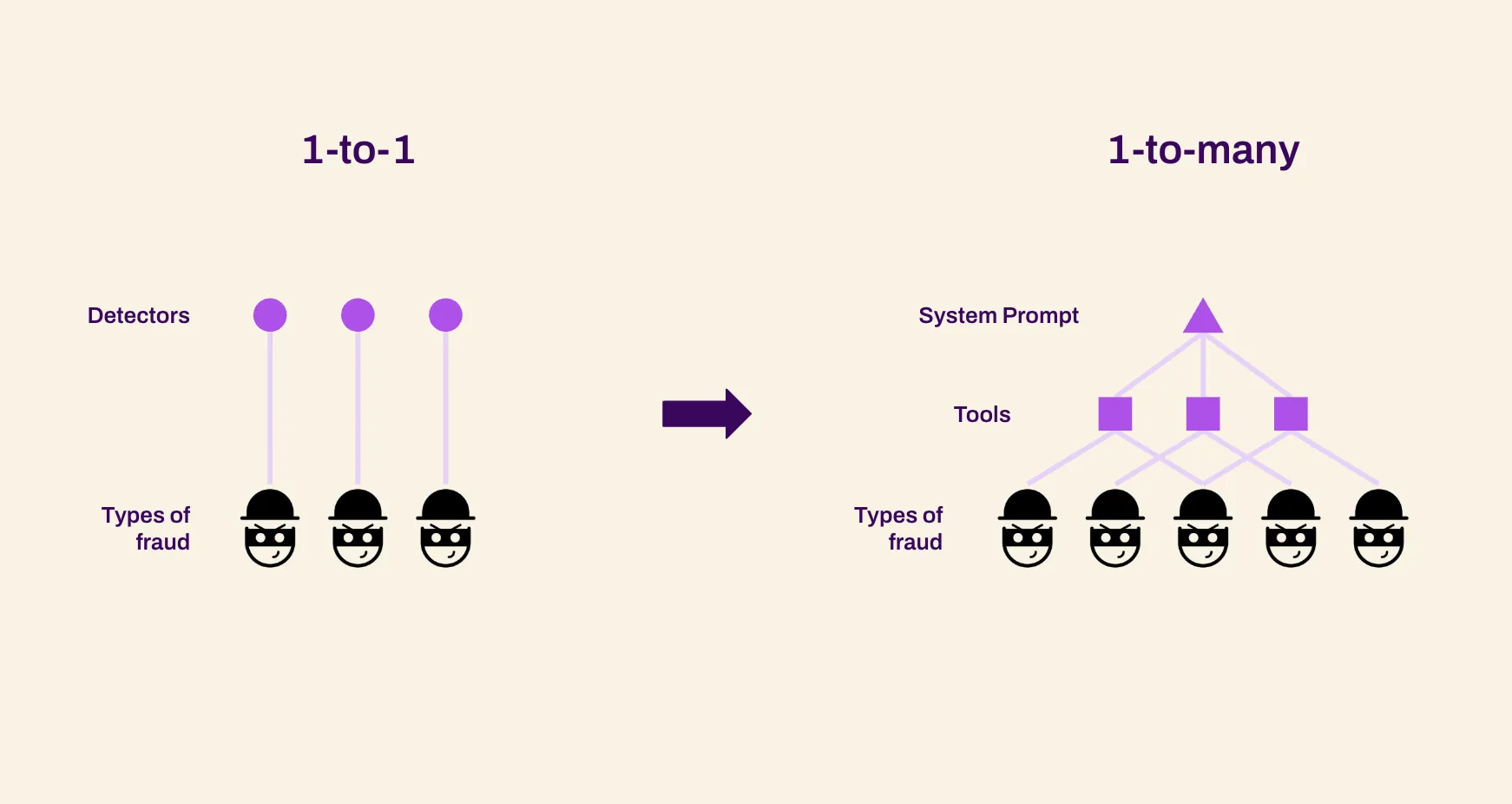

This shift also breaks the 1-to-1 model of fraud detection. Traditional systems rely on one detector for one fraud type. But with agentic systems, a single AI Agent can orchestrate many tools at once, tackling multiple fraud types in parallel. That means catching fraud previously too rare or too complex to justify building a dedicated detector for — and even catching the first instances of entirely new fraud patterns.

The impact is profound: agentic systems don’t just automate workflows; they expand the boundaries of what’s possible. They allow fraud teams to defend against the long tail of fraud, reduce false negatives, and move from reactive detection to proactive defense.

That realization led us into large language models. In 2022, we began experimenting with LLMs to enhance document parsing and context understanding. By 2023, we had integrated them into workflows to generate clearer, audit-ready explanations of risk signals. But the real breakthrough came in 2024, when we moved beyond using LLMs as helpers and started building agentic systems.

Here’s how the evolution unfolded:

- Detectors (2017–2021): One detector for one fraud type — effective for common fraud, but narrow in scope.

- LLMs (2022–2023): Better understanding of documents, more contextual explanations, but still limited by linear workflows.

- Agentic Systems (2024+): LLMs orchestrating multiple tools, creating dynamic investigation plans, validating results, and adapting mid-flight.

With this shift, we broke the 1-to-1 model of fraud detection. Instead of one detector for one type of fraud, our agents can run many tools in parallel, catching fraud that was previously uneconomical or technically impossible to stop — including the very first instances of new fraud types.

Why it matters right now

Deepfake fraud is no longer rare. It’s routine.

In today’s lending and onboarding pipelines, fraudulent documents show up regularly, often buried among thousands of legitimate ones. As attackers scale their tactics using generative tools, defenders can’t rely on filters alone. They need agents that investigate.

Financial institutions face a dual challenge: increase efficiency while preserving trust. But the systems many teams still use were built for a different era — one where fraud was infrequent and somewhat predictable. That’s no longer the case.

The opportunity in front of us is this:

- Catch fraud that wasn’t previously worth catching — because it was rare or too manual to justify

- Catch fraud we’ve never seen before — because it doesn’t resemble anything in the training data

And do it all without increasing operational burden.

The key to closing the fraud reaction window — that critical gap between attack and response — is systems that can reason, adapt, and act.

Our progress and what’s next

Since launching our AI Agents in late 2024, we’ve seen:

- $3M+ in fraud prevented by Logix Federal Credit Union in just eight months

- Manual research time cut from 30 minutes to under 90 seconds

- Detection of AI-generated forgeries, including GenAI paystubs and synthetic bank statements

But this is just the beginning. Over the next few years, our vision is to transform fraud detection from static, rule-based systems into adaptive, agentic workflows that can reason across documents, tools, and data sources to uncover fraud previously undetectable.

A call to action for financial services

The fraudsters are already using AI. To stay ahead, financial institutions need systems that don’t just detect fraud, but adapt to it.

That’s why at Inscribe, our mission is to help risk teams catch fraud with confidence, and our vision is AI for the modern fraud fighter. We believe the future isn’t rules-based — it’s agentic. And that future is already here.

If you’re defending against document fraud, it’s time to move beyond static tools. AI Agents are not just the next step. They’re the foundation for modern, adaptive fraud defense — and they’re ready to work alongside your team today.

If you’re a bank, lender, or fintech interested in exploring how you can too, I’d love to chat. Grab time on my calendar or reach out to me on LinkedIn.

About the author

Ronan Burke is the co-founder and CEO of Inscribe. He founded Inscribe with his twin after they experienced the challenges of manual review operations and over-burdened risk teams at national banks and fast-growing fintechs. So they set out to alleviate those challenges by deploying safe, scalable, and reliable AI. A 2020 Forbes “30 Under 30 Europe” honoree, Ronan is also a Forbes Technology Council Member and has been featured in Fast Company, VentureBeat, TechCrunch, and The Irish Times. He graduated from the University College Dublin with a Bachelor's degree in Electronic Engineering and later completed the Y Combinator startup accelerator program.

What will our AI find in your documents?

Book a demo and we'll share more about our complimentary document fraud audit.

FAQs

What is document fraud in the age of generative AI?

Document fraud today includes AI-generated and AI-altered documents such as deepfake paystubs, bank statements, invoices, and utility bills. Generative AI allows fraudsters to create highly realistic financial documents at scale, making it increasingly difficult to rely on visual checks or traditional verification methods.

Why are document deepfakes such a serious risk for financial institutions?

Document deepfakes are dangerous because they are inexpensive to produce, easy to scale, and hard to detect with legacy systems. Fraudsters can generate thousands of realistic documents in minutes, overwhelming manual review teams and slipping through systems designed for a lower-volume, pre-AI fraud landscape.

How is AI changing document fraud?

AI has shifted document fraud from simple manipulation to fully synthetic creation. Modern tools can replicate formatting, logos, transaction histories, and even natural errors. This means fraud detection can no longer rely on whether a document “looks real,” but must determine whether it can prove authenticity through deeper analysis.

Why did Inscribe start focusing on document fraud?

Inscribe was founded after firsthand experience with the limitations of manual document verification. The founders saw risk teams overwhelmed by reviews and customers frustrated by slow decisions. From the beginning, Inscribe focused on building AI systems that reason like expert fraud analysts — but operate at machine speed and scale.

Why aren’t traditional fraud detection systems enough anymore?

Most traditional fraud tools are linear and rules-based, designed to catch known patterns. These systems struggle when fraud tactics evolve or appear in new forms. In a world of generative AI, fraud is dynamic, creative, and unpredictable — requiring systems that can reason, adapt, and investigate rather than just classify.

What are agentic AI systems in fraud detection?

Agentic AI systems are AI-driven agents that can plan investigations, choose tools, validate evidence, and adapt as new information emerges. Instead of running a single detector, an AI Agent can orchestrate multiple analyses across documents, data sources, and signals to reach a reasoned conclusion.

How are agentic systems different from using LLMs alone?

Large language models improve document understanding and explanations, but on their own they are still limited by linear workflows. Agentic systems use LLMs to orchestrate actions — running multiple tools in parallel, validating results, and adjusting strategy mid-investigation — enabling deeper and more adaptive fraud detection.

Why is agentic AI critical right now?

Deepfake document fraud is already routine, not theoretical. Financial institutions need systems that can catch rare fraud, entirely new fraud patterns, and AI-generated forgeries — without increasing operational burden. Agentic AI closes the gap between attack and response by enabling proactive, adaptive defense.

What kinds of fraud can agentic systems detect that others miss?

Agentic systems can detect:

- Rare fraud that was previously too manual to justify investigating

- New fraud patterns not present in historical training data

- Complex cases involving multiple documents and subtle inconsistencies

This allows teams to defend against the “long tail” of fraud that traditional systems overlook.

What results has Inscribe seen with agentic AI?

Since launching AI Agents, Inscribe customers have:

- Prevented millions in fraud losses in under a year

- Reduced manual investigation time from ~30 minutes to under 90 seconds

- Detected AI-generated paystubs, synthetic bank statements, and other deepfake documents

These results show that agentic systems can deliver both stronger protection and greater efficiency.

What is Inscribe’s long-term vision for fraud detection?

Inscribe’s vision is to move the industry from static, rules-based tools to adaptive, agentic fraud defense. The future of fraud detection is systems that can reason across documents, tools, and data sources — and evolve as fraud evolves.

Who should consider agentic document fraud detection?

Banks, lenders, credit unions, and fintechs that rely on customer-submitted documents — especially during onboarding and underwriting — should consider agentic document fraud detection. This is especially critical for organizations facing rising fraud volume without the ability to scale manual reviews.