Top 5 types of document fraud in 2025

Table of Contents

[ show ]- Loading table of contents...

Brianna Valleskey

Document fraud doesn’t always announce itself.

Sometimes it’s a receipt with a few too many line items.

Sometimes it’s a pay stub that looks accurate (but the date tells a different story).

And sometimes, it’s a flawless PDF that was never real in the first place.

We’ve reached a point where fake documents are no longer confined to bad Photoshop jobs.

Fraudsters have a toolbox that includes everything from generative AI to downloadable templates, and they’re not afraid to use them.

At Inscribe, we’ve analyzed millions of documents across industries, including business lending, consumer lending, fintech platforms, tenant screening, and beyond. What we’ve found is that the ways documents are manipulated tend to fall into repeatable patterns. These aren’t just odd edge cases. They’re evolving tactics that reflect how fraud is scaling in the real world.

These are the five types of document fraud we see most often today. And more importantly, here’s how AI Agents are adapting to stop them.

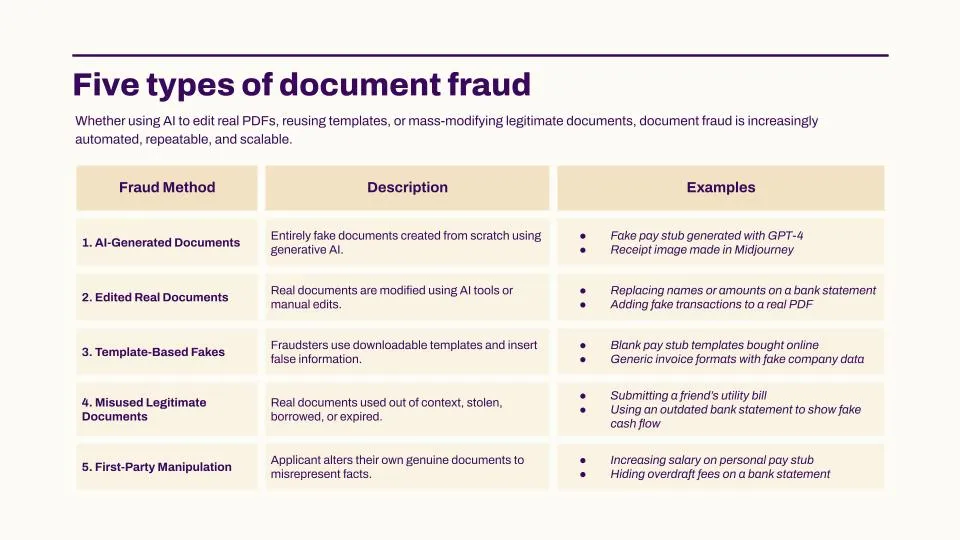

Top five types of document fraud in 2025

1. AI-Generated Documents

What it is:

These are entirely fake documents, created from scratch using generative AI. There’s no original version. No metadata trail. No human-crafted template. Just an AI model prompted to create a document that looks real — often a pay stub, bank statement, invoice, or receipt.

Tools like GPT-4V or Midjourney can now produce highly convincing document visuals, including logos, fonts, signatures, and even background textures. But just because a document looks like something you’d find in an inbox or underwriting system doesn’t mean it ever existed in the real world.

What it looks like:

- A synthetic pay stub with clean formatting and no signs of wear

- A receipt showing expenses at a real store, but that store has no record of the transaction

- A bank statement with believable layout but pixel-perfect alignment that’s almost too perfect

- A PDF with no creation history, no metadata, and no device signature

These documents often escape simple detection methods because visually, they mimic the structure of real ones. But they’re missing the nuance that comes from actual use — the small imperfections, embedded metadata, or file lineage that indicate real-world origin.

Why it matters:

Today’s AI-generated documents are still detectable, if you know what to look for. They tend to be overly polished, contain inconsistencies in fonts or spacing, and are often missing critical metadata. But that gap is closing and fast.

2. Edited Real Documents

What it is:

These are genuine documents (authentic files issued by real financial institutions) that have been tampered with to mislead reviewers. Think of them as wolves in sheep’s clothing. The shell is real. But the content has been subtly manipulated: new transactions inserted, names changed, balances adjusted, or metadata wiped clean.

What it looks like:

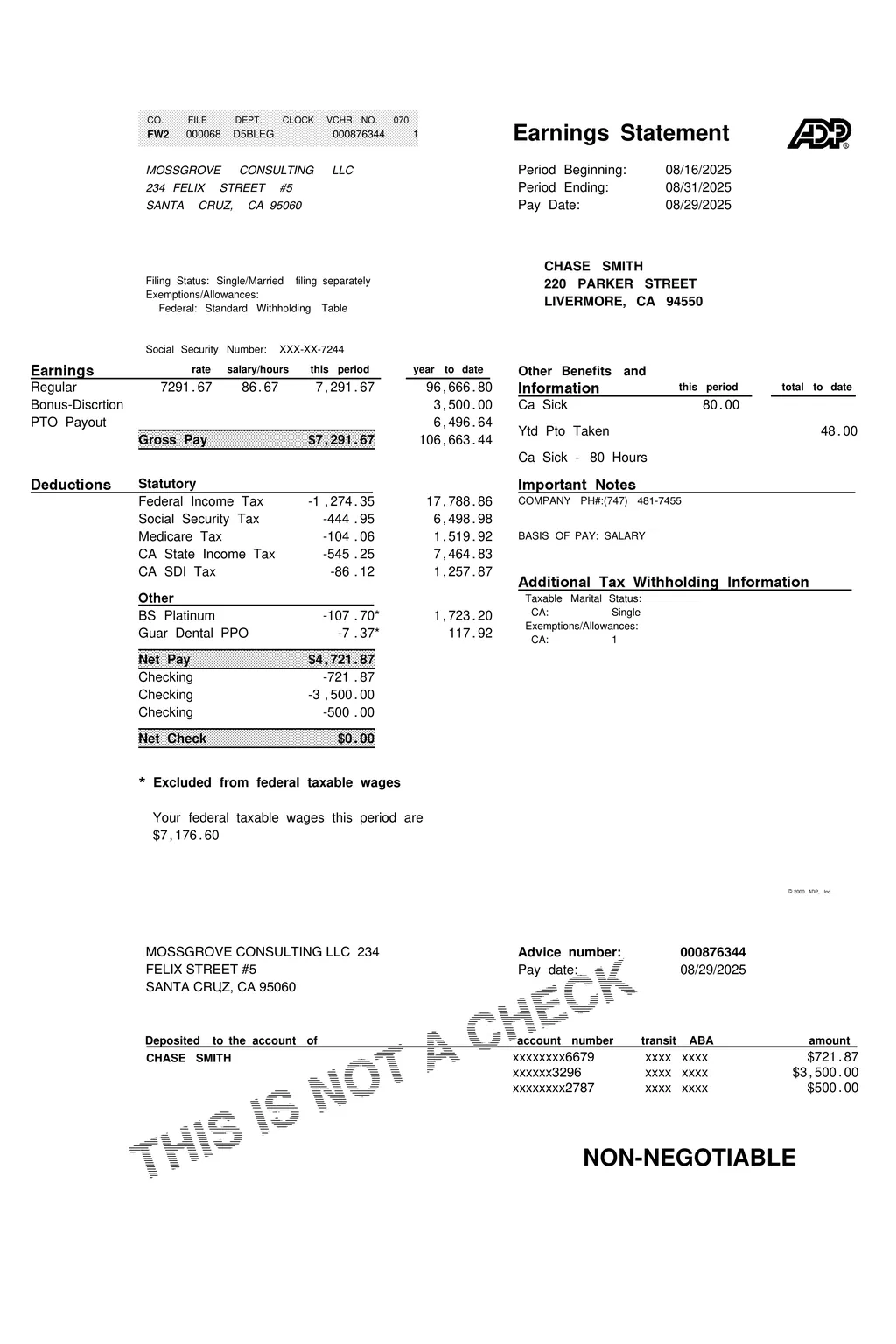

- A real paystub where the salary figure has been bumped up by a few thousand dollars

- A bank statement with one additional (but fake) direct deposit

- A PDF that was opened, edited, and resaved with a different name, account number, or date

Why it matters:

This is arguably the most dangerous form of document fraud. The format, structure, and design pass muster because they’re real. The fraudster didn’t create a fake document—they just surgically modified a real one. Which means traditional detectors (that rely on visual cues or format irregularities) often miss them entirely.

AI makes this even more accessible. With just one prompt, a fraudster can get a clean edit of a real file that swaps numbers, dates, or employers in a way that looks seamless. And the rise of AI-powered PDF editors and image manipulators has lowered the barrier of entry even further.

The result? A new wave of forgeries that don’t look suspicious. They are suspicious, but only if you know where to look.

3. Template-Based Fakes

What it is:

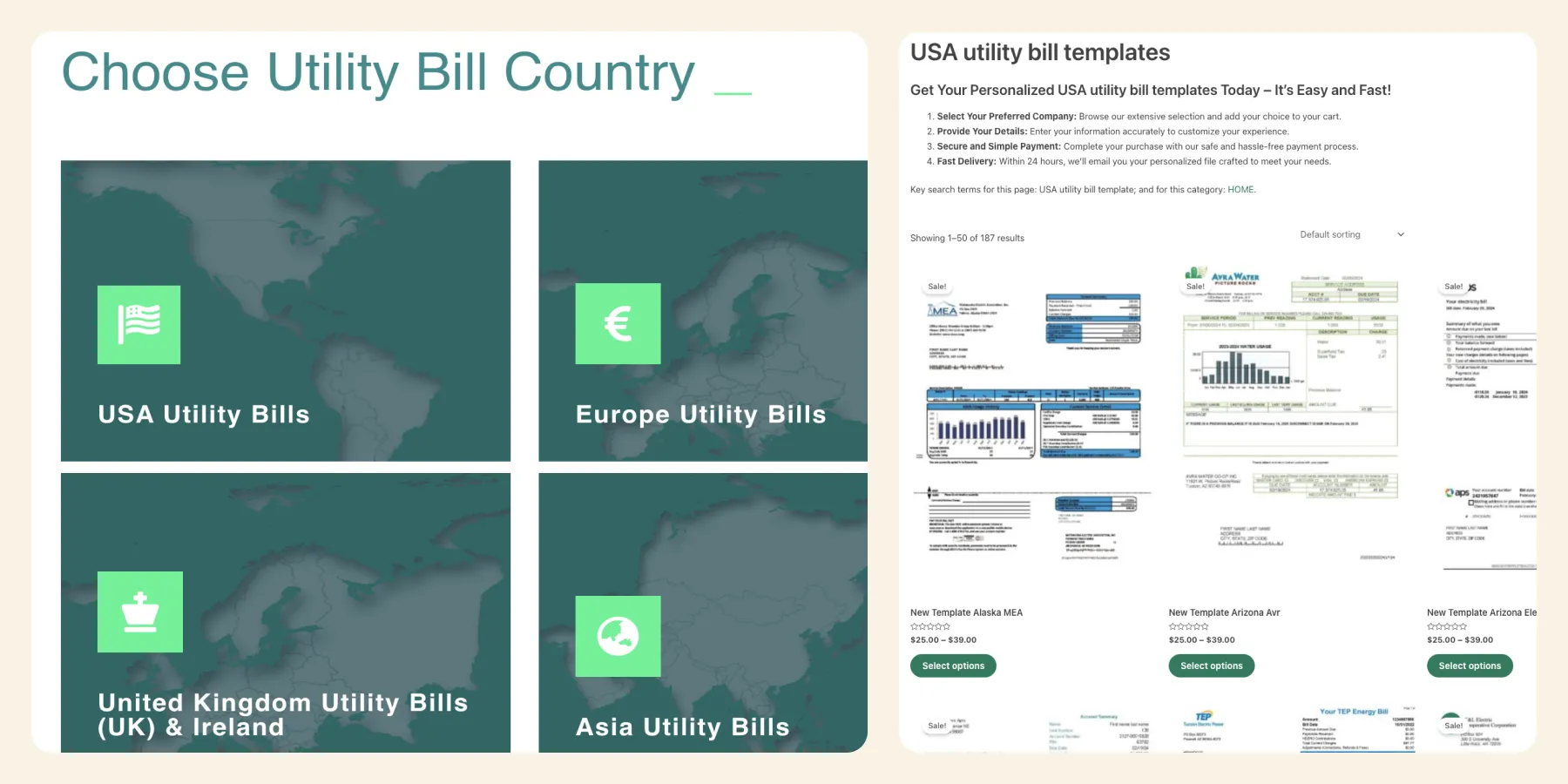

Template-based fraud is exactly what it sounds like—fraudsters using pre-made document templates (often downloaded, purchased, or shared in fraud forums) to mass-produce fake financial documents. These templates look legitimate on the surface. They're often designed to mimic real banks, employers, or government forms. But dig a little deeper, and the patterns start to emerge.

What it looks like:

We’ve seen everything from:

- Pay stub templates populated with fabricated hours, names, and amounts

- Invoices with identical formatting and structure—just the client and total swapped

- Bank statements recreated using spreadsheet templates downloaded from Telegram or dark web sites

- Loan applications submitted with the same exact document layout, over and over

The visual polish of these templates is getting better. But what fraudsters often miss are the subtle inconsistencies that give them away—like a font weight slightly off from a bank’s usual template, or metadata that reveals the source software wasn’t a financial institution at all.

Why it matters:

Template-based fraud scales easily. One well-designed file can be filled out dozens, or hundreds, of times and used across multiple applications. This kind of fraud isn’t one-off. It’s systemic. It’s fast. And it often shows up in organized rings, where the same layout crops up with different applicant names and minor edits.

4. Misused Legitimate Documents

What it is:

These aren’t fake documents. They’re real ones—just used dishonestly. Fraudsters might submit someone else’s utility bill, reuse an expired bank statement, or provide a document that’s technically valid but entirely out of context.

What it looks like:

- A roommate’s internet bill used to “verify” residency

- A six-month-old paystub submitted as proof of current employment

- A previously verified document resubmitted across multiple applications

Why it matters:

This type of fraud is subtle. There’s no Photoshop involved, no tampering with fonts or metadata. And yet, it’s equally capable of misleading even the most seasoned risk analyst. That’s because the document itself isn’t the problem—it’s the intent behind its submission.

Misused documents often sneak past traditional fraud checks because the tools we’ve used in the past focused on file-level integrity (Is it edited? Is it a forgery?). But that’s no longer enough. We also need to ask: Is this document truthful in its current context? Is it still valid, relevant, and trustworthy for this specific application?

5. First-Party Manipulation

What it is:

This is fraud that hits a little closer to home. Instead of submitting a totally fake document or purchasing a forgery, applicants take real documents (like their own pay stubs or bank statements) and alter them to misrepresent key details.

It’s not always elaborate. In fact, it’s often subtle. But that’s what makes it so dangerous.

What it looks like:

- Increasing the net income on a real pay stub by just a few hundred dollars

- Cropping out a bounced check or overdraft fee from a bank statement

- Deleting evidence of a payday loan from transaction history

- Masking recent account activity to hide cash flow gaps or failed debits

These tweaks can be hard to catch because the underlying document is authentic—it came from the actual source, and it belongs to the person applying. It just doesn’t tell the whole truth anymore.

Why it matters:

It’s personal. First-party manipulation reveals intent—and often, desperation. It doesn’t always come from professional fraudsters. Sometimes it's individuals trying to improve their odds of loan approval, access credit they wouldn’t otherwise qualify for, or hide financial behavior they believe will trigger rejection.

But make no mistake: it’s still fraud. And it’s often the hardest kind to detect. Why? Because it blends truth with fiction. The document isn’t fake in the traditional sense; it’s real but wrong. And in many systems, that’s enough to get through undetected.

The common thread? Document fraud at scale

Each of the five fraud types outlined above — from template fraud and generative forgeries to , fake transactions reused layouts — comes with its own set of risks. But what keeps risk leaders up at night isn’t just a single fraudulent document. It’s what happens when the same techniques are deployed over and over again, at scale.

In the age of generative AI, we're not just talking about one-off forgeries. We're talking about thousands of high-quality fakes produced in minutes. Templates that can be downloaded and personalized. Paystubs and bank statements that can be generated or altered with a single prompt. And document editing tools that are more accessible and intuitive than ever.

Document fraud has gone from opportunistic to operationalized.

We’ve seen:

- The same forged invoice template used across dozens (sometimes hundreds) of loan applications.

- Expense reimbursement scams where fraudsters used AI to edit real receipts for higher amounts.

- Document layouts being recycled—again and again—by entire fraud rings targeting different financial institutions.

These are part of repeatable playbooks built to evade legacy systems. To stop fraud at this scale, we can’t rely on static rules or generic fraud scores. We need systems that are dynamic i.e. have the ability to reason, investigate, and adapt.

How AI Agents detect fake documents

Inscribe’s AI Agents are designed to deeply understand documents. Built from the ground up to support modern risk teams, our agents combine deep technical rigor with human-style reasoning. They surface not only that something is wrong, but why, where, and how confident they are in that finding.

Here’s what that looks like in practice:

1. They screen and structure every document immediately

The first step to understanding a document is breaking it down into parts that can be analyzed. Inscribe’s agents extract and structure data across hundreds of financial institutions and document types, everything from paystubs and bank statements to utility bills and invoices.

This structured foundation allows the agents to:

- Detect unusual formatting or layout differences

- Flag template reuse across multiple applications

- Spot discrepancies in document structure that would be missed by visual inspection

This happens the moment a document enters the workflow, so fraud detection starts early—and fast.

2. They detect fraud patterns with 35+ document-level signals

Our agents don’t rely on a single signal or score. Instead, they analyze a constellation of signals—from visual to forensic to semantic.

Some examples include:

- Visual artifacts from AI generation or manipulation

- Network-level patterns like repeated document layouts across different identities

- File history anomalies, such as software used or editing sequences

- Logic errors (e.g., math that doesn’t check out or unrealistic deposit patterns)

These signals combine to reveal not just if a document is fraudulent, but how and why—giving analysts much-needed clarity.

3. They validate data against external sources

To make a judgment about a document’s authenticity, AI Agents don’t stop at internal clues. They pull in third-party data from:

- Public business registries

- Employer records

- Known document libraries

- Historical application data

This lets them cross-check whether a listed employer actually exists, if the business operates in the claimed state, or if the income level aligns with known data for that job title.

It’s like giving each document a second opinion—grounded in facts.

4. They explain their findings in plain language

Detection is only useful if it’s actionable. That’s why Inscribe’s agents surface results with full transparency.

Instead of black-box scores, analysts get:

- A natural language summary of findings

- Linked evidence and red flags (e.g. “Net income was increased from $2,100 to $4,300”)

- Contextual scoring that reflects risk based on use case, not just technical anomalies

This empowers fraud and risk teams to move faster, ask better follow-ups, and act with more confidence.

Document fraud in 2026 and beyond

As generative AI becomes more powerful and accessible, the barrier to entry for creating realistic, high-quality fake documents drops dramatically. What once required design skills and effort can now be done with a single prompt. The result is a new wave of fraud that looks authentic, passes visual inspection, and spreads fast across the financial ecosystem.

That’s why detection strategies can’t rely on visuals alone. Or static rules. Or siloed systems. Fraud today demands systems that are as adaptive, creative, and fast-moving as the adversaries behind it.

At Inscribe, we’ve spent years studying how document fraud evolves — from tampering and templates to fully AI-generated forgeries — and building AI Agents capable of reasoning through that complexity. Our agents don’t just flag what’s fake; they understand what’s real. They contextualize, validate, and explain their findings in ways that help risk teams move faster and act with confidence.

As Ronan Burke, our co-founder and CEO, recently wrote:

“We’re entering an era where it’s no longer a question of whether a document looks real, but whether it can prove it’s real.”

His piece dives deeper into the technological shift underway (from traditional detectors to agentic systems capable of reasoning, planning, and adapting in real time. It’s a look at where fraud detection is heading next) and why now is the time to evolve with it.

Fraudsters are getting faster, more creative, and more connected. Your systems can too.

Want to learn more about document fraud and see how Inscribe’s agentic AI detects deepfakes? Request a free trial to schedule a call with our team!

About the author

Brianna Valleskey is the Head of Marketing at Inscribe AI. A former journalist and longtime B2B marketing leader, Brianna is the creator and host of Good Question, where she brings together experts at the intersection of fraud, fintech, and AI. She’s passionate about making technical topics accessible and inspiring the next generation of risk leaders, and was named 2022 Experimental Marketer of the Year and one of the 2023 Top 50 Woman in Content. Prior to Inscribe, she served in marketing and leadership roles at Sendoso, Benzinga, and LevelEleven.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.